Investing is often seen as something only the wealthy can afford to do, but that’s a myth. In reality, you can start investing with as little as $100 or even less. Getting started early, even with a small amount, can make a significant difference in your financial future due to the power of compounding. Here’s how you can begin your investment journey with $100 or less.

1. Understand the Basics of Investing

Before diving into investments, it’s essential to understand some basic principles:

- Risk and Return: Investments come with varying levels of risk and potential returns. Higher returns typically come with higher risks.

- Diversification: Spreading your investments across different assets can reduce risk.

- Compound Interest: Earnings on your investments can generate their own earnings, leading to exponential growth over time.

2. Set Clear Financial Goals

Determine why you want to invest and what you hope to achieve. Are you saving for retirement, a down payment on a house, or a future vacation? Having clear goals will help you choose the right investment strategies and stay motivated.

3. Choose a Suitable Investment Platform

Online Brokerages

Many online brokerages have eliminated account minimums and reduced trading fees, making it easier to start with a small amount of money. Some popular options include:

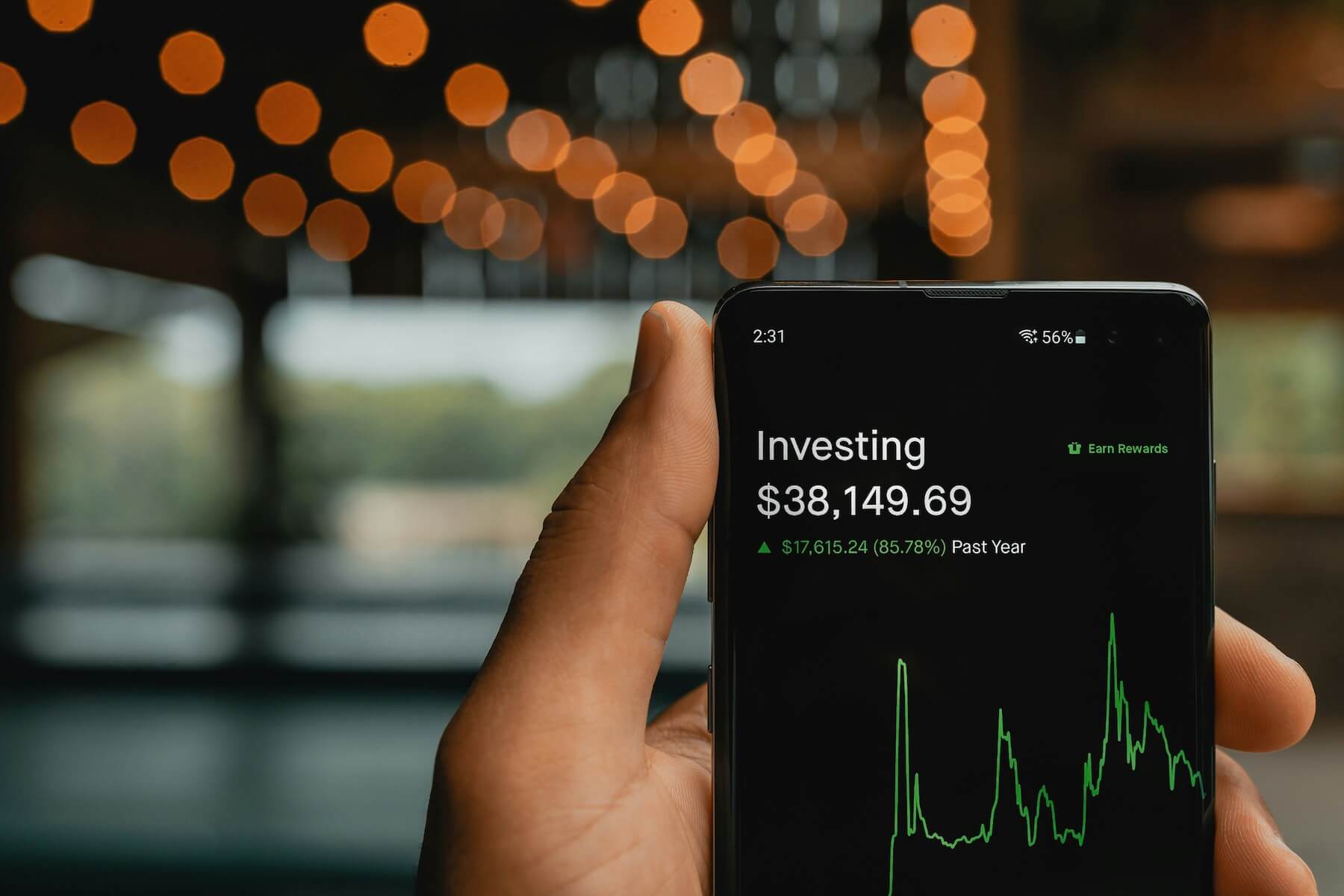

- Robinhood: Offers commission-free trades on stocks, ETFs, and cryptocurrencies.

- E*TRADE: Provides a range of investment options and educational resources.

- Charles Schwab: No minimum account balance and a variety of investment choices.

Micro-Investing Apps

Micro-investing apps are designed specifically for beginners with limited funds. They allow you to invest small amounts of money, often rounding up your purchases to the nearest dollar and investing the spare change. Popular micro-investing apps include:

- Acorns: Automatically invests your spare change from everyday purchases.

- Stash: Allows you to invest in fractional shares of stocks and ETFs with as little as $5.

- Robinhood: Offers fractional shares, making it possible to buy a portion of high-priced stocks with a small amount of money.

Robo-Advisors

Robo-advisors provide automated, algorithm-driven financial planning services with little to no human supervision. They create a diversified portfolio based on your risk tolerance and goals. Some popular robo-advisors are:

- Betterment: Offers automated investing with low fees and no account minimum.

- Wealthfront: Provides a range of investment options with a low minimum deposit.

- SoFi Invest: No fees for automated investing and low-cost access to various asset classes.

4. Investment Options for Small Budgets

Exchange-Traded Funds (ETFs)

ETFs are a great option for beginners with limited funds. They are baskets of securities that trade on an exchange like a stock, providing diversification at a low cost. Many ETFs have low expense ratios, making them affordable for small investors.

Fractional Shares

Fractional shares allow you to buy a portion of a share of stock, making it possible to invest in high-priced stocks like Amazon or Google with a small amount of money. Many online brokerages and micro-investing apps offer fractional shares.

Index Funds

Index funds are mutual funds or ETFs designed to track a specific market index, such as the S&P 500. They offer diversification and low fees, making them an excellent choice for beginners.

Bonds

Bonds are fixed-income investments that pay interest over time. While individual bonds may require a higher initial investment, bond ETFs and mutual funds allow you to invest in bonds with a smaller amount of money.

5. Start Investing

Step 1: Open an Account

Choose an investment platform that suits your needs and open an account. This process typically involves providing some personal information and linking your bank account.

Step 2: Fund Your Account

Deposit your initial investment amount, whether it’s $100 or less. Many platforms allow you to set up automatic transfers to make regular contributions easier.

Step 3: Choose Your Investments

Select the investments that align with your goals and risk tolerance. If you’re unsure where to start, consider a diversified ETF or robo-advisor portfolio.

Step 4: Monitor and Adjust

Regularly review your investments and make adjustments as needed. Stay informed about market trends and consider rebalancing your portfolio to maintain your desired asset allocation.

6. Tips for Successful Investing

Start Small and Be Consistent

Even if you can only invest a small amount each month, consistency is key. Regular contributions, no matter how small, can grow significantly over time due to compound interest.

Reinvest Dividends

If your investments pay dividends, reinvest them rather than taking them as cash. This helps your investment grow faster.

Stay Informed

Educate yourself about investing and stay updated on market trends. Many investment platforms offer educational resources to help you make informed decisions.

Be Patient

Investing is a long-term game. Avoid the temptation to make frequent trades based on short-term market fluctuations. Stay focused on your long-term goals.

Conclusion

Starting your investment journey with $100 or less is entirely possible and can set you on the path to financial growth and security. By understanding the basics, setting clear goals, choosing the right investment platform, and being consistent, you can make the most of your small investments and watch them grow over time. Remember, the key to successful investing is patience and consistency. Start today and take the first step towards building a prosperous financial future.